In a landmark legal battle with profound implications for millions of student loan borrowers, the Supreme Court is set to decide on the constitutionality of President Biden's ambitious student loan forgiveness plan. Expected by late June, the ruling of this case, Biden v. Nebraska, could reshape the future of student loan relief initiatives and have far-reaching effects on borrowers and the nation's economy.

The Biden administration's plan, initially proposed during the 2020 presidential campaign, promises to cancel up to $20,000 in student loans for borrowers who received a Pell Grant and up to $10,000 for borrowers without the grant. More than 30 million people are estimated to benefit from the proposed plan. However, the legal foundation for this plan rests on the interpretation of the HEROES Act of 2003, enacted to safeguard service members from financial distress during the Iraq and Afghanistan war.

The administration contended that the ongoing COVID-19 pandemic qualified as a national emergency which granted the U.S. Secretary of Education broad authority to waive or modify regulations related to student loans. By leveraging this authority, they contended that the forgiveness plan aimed to alleviate the financial burdens exacerbated by the pandemic.

Nevertheless, Republican-led states have launched legal challenges against the plan, asserting that it violates the separation of powers and the Administrative Procedure Act. Six states, including Nebraska, have filed lawsuits, contending that the plan harms their state-based loan servicing companies and unfairly excludes certain borrowers from loan forgiveness.

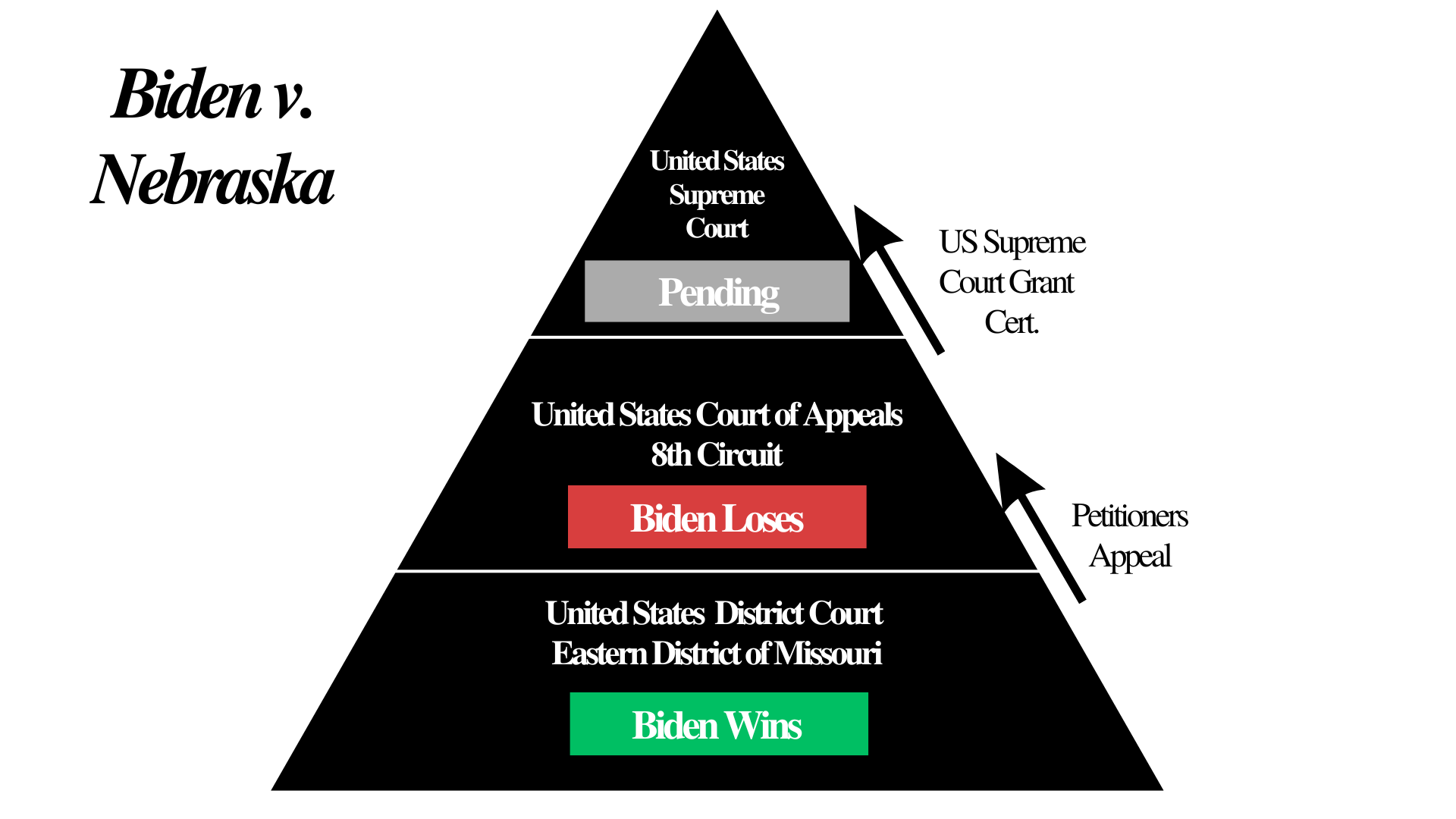

Initially, a federal district court judge dismissed the lawsuit, stating that while the coalition of states did pose “important and significant challenges to the debt relief plan,” they did not inhibit legal standing to sue. On appeal, however, the U.S. Court of Appeals blocked the continuation of the plan. Now, the Supreme Court has agreed to hear two of the legal challenges, thrusting the constitutional debate into the spotlight.

What is Standing?

A plaintiff (who is suing) need to prove to the court that they’ve been harmed by the policy.

The U.S. Court of Appeals contended that the states did indeed have legal standing. The panel of judges argued that the Missouri Higher Education Loan Authority (MOHELA), headquartered in Missouri, would face financial implications under the student loan forgiveness plan.